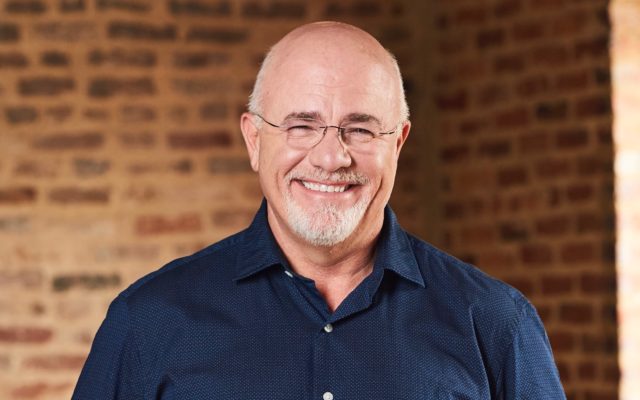

Dave Says: How to choose the right length term insurance

Dear Dave,

My husband and I are 24, we’re debt-free, and we’re just a few weeks of saving away from having a fully-funded emergency fund. Each of us has a 401(k) plan at work, and right now we’re concentrating on life insurance purchases. You always recommend term insurance, but how long should the coverage last?

Jenny

Dear Jenny,

Congratulations on being super smart with your money! It sounds like you two are starting out on the right foot.

Generally, I recommend 15- or 20-year level term policies—unless you have children. Since you didn’t mention any kids, I can only assume they’re not in the picture at this point. However, if you two decide to grow your family in the future, I’d advise converting those to 30-year term policies. You’ll want the insurance there to protect everyone in the family, until the kids are grown and out on their own. In the years after, continued saving and wealth building will lead you to a point where you’re both self-insured.

You two have done an excellent job with your finances. Keep up the good work!

—Dave

You Might Also Like