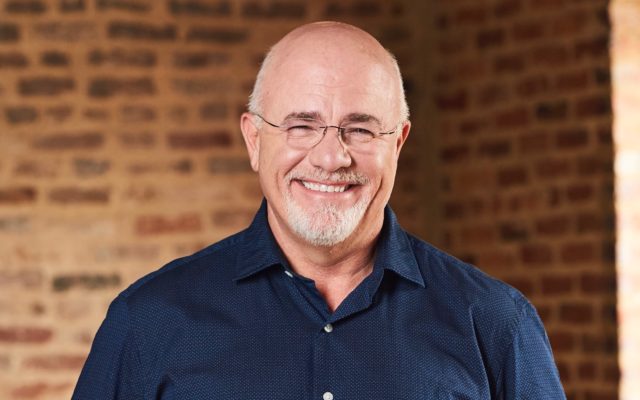

Dave Says: How to scrounge together an emergency fund

Dear Dave,

My fiancé and I just started your class, but we’re having trouble getting our beginner emergency fund together. We both work full-time, and I make $59,000 a year while he has worked in retail for several years and makes $22,000 to $25,000. I’m trying to manage a couple of side jobs, but we just can’t seem to get our budget to work in a way that will allow us to save anything. Can you help us?

Adrienne

Dear Adrienne,

First of all, your finances should remain separate until you’re married. There’s shouldn’t be a “we” in terms of money at this point. You can always run a single budget that you both look at and prepare for after you’re married, but right now he shouldn’t be paying your bills and you shouldn’t be paying his bills.

The biggest problem I see is that he’s making no money. He needs to get a better job. He can’t pay his bills, and in the process, he’s sucking you dry. I’m sure your fiancé is a good, hard-working man, but he needs to make a serious career shift soon—like now!

In the meantime, this guy needs to take on a part-time job or two until he gets that career shifted. It’s not really a budgeting problem you’re looking at. It’s an income issue.

—Dave

You Might Also Like