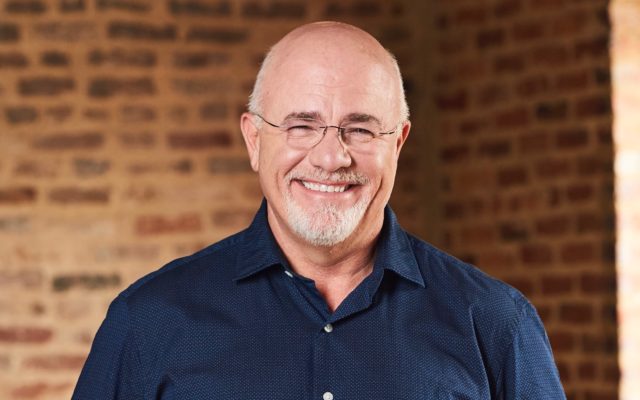

Dave Says: Rental income is not easy income

Dear Dave,

I’m 35, and I’ve always wanted to own rental property. I think I’ve found a deal that would work for me. I want to take $20,000 out of my thrift savings account to use as a down payment on the property. I could rent the place for $1,400 a month, and my loan payment would be $1,100 a month. What do you think about this idea?

Nathan

Dear Nathan,

I love real estate, so I understand the allure. But what you’re telling me is you want to cash out part of your retirement, get hit with a penalty and take on debt, to buy an investment property. I wouldn’t do it.

I’ve got a feeling you’ve never been a landlord before. Bringing in $1,400 and paying out $1,100 may seem like a good place to be, but you haven’t figured all the risk into your equation. Rental properties just sit there empty sometimes. Other times you have renters who don’t pay, repairs, and people who just tear up things. In other words, you won’t be able to count on an easy $300 in your pocket every month.

Like I said, I totally get your fascination with real estate. But my advice is to save up, and pay cash for one decent rental property to see if this game is really for you.

—Dave

You Might Also Like