Dave Says: Should I buy another long-distance rental?

Dear Dave,

My husband and I are active duty military stationed outside Washington, D.C. We’re completely debt-free and have finished your entire Baby Steps plan, but last month our paid-for rental house in Florida burned down. It was empty at the time, so no one was hurt, and we got a check from the insurance company for $165,000. We both plan to serve another nine years, and we know we could be moved around during that time. We love that area in Florida, though, and want to go back there one day. Do you think we should use the money to buy another place and rent it out until we’re ready to retire from the military?

Carrie

Dear Carrie,

Wow! I am so proud of you guys. You’re at the point where you’re living—and giving—like no one else. You have achieved financial peace!

Now, I love real estate. But it’s always a good idea to have your rental property near you. I wouldn’t buy a place in Florida if I lived in Washington, D.C., and there was a chance I could be re-assigned pretty much anywhere in the world. I’d just scrape the lot where the rental house was, sell it, and invest that cash along with the insurance money.

Long distance landlording is really tough. It’s stressful, and it adds an even bigger element of risk to the rental property equation. It’s not something I generally recommend. If it’s something you guys want to take a chance on, though, you’re certainly in the financial position to do it. Just remember to pay cash for the whole thing, and if possible, try to get a location where you’d both like to end up when your military careers are over.

Congratulations, you two! And thank you for your service to our country.

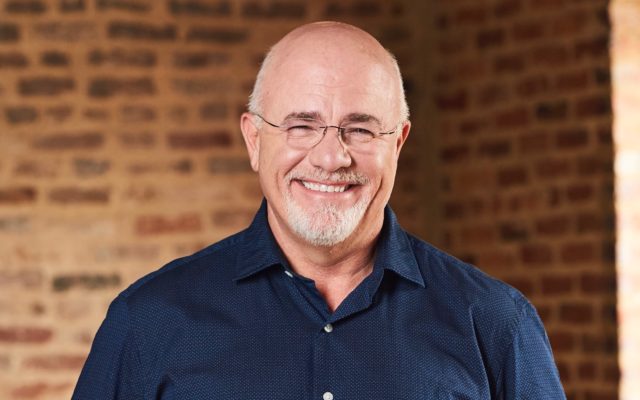

—Dave

You Might Also Like