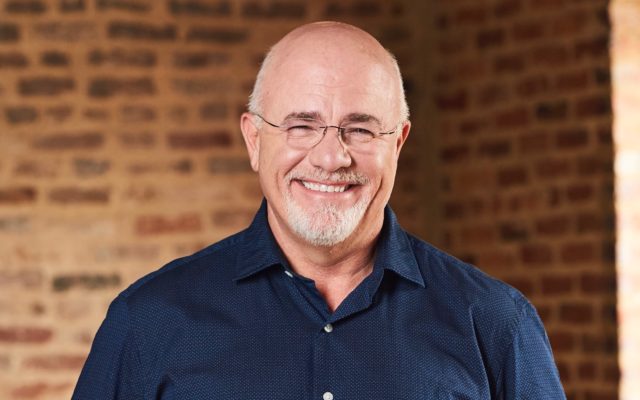

Dave Says: Should we increase our life insurance?

Dear Dave,

My husband and I are on Baby Step 3b, and we’re saving for a house. We’re out of debt and both of us make good money, plus we each have 20-year level term life insurance policies with coverage equaling 10 times our individual incomes. We also have an emergency fund equal to six months of expenses. I recently received a promotion at work, with a subsequent raise of $10,000. Should I update my life insurance policy to reflect this new income?

Maria

Dear Maria,

I think you’re okay right now. I’d evaluate it, and maybe update the amount every three or four years. But as you get out of debt and build wealth, and as the kids get older, the real question to ask yourselves is how much less life insurance do you need?

As your income increases and you get in better and better financial shape, it’s not going to be necessary to have 10 to 12 times your income wrapped up in life insurance policies. That’s just a starting point.

Would your husband and any kids be well taken care of based on your current life insurance amount? Would you and any kids be okay based on his life insurance? If the answer to both questions is yes, you’re good!

—Dave

You Might Also Like