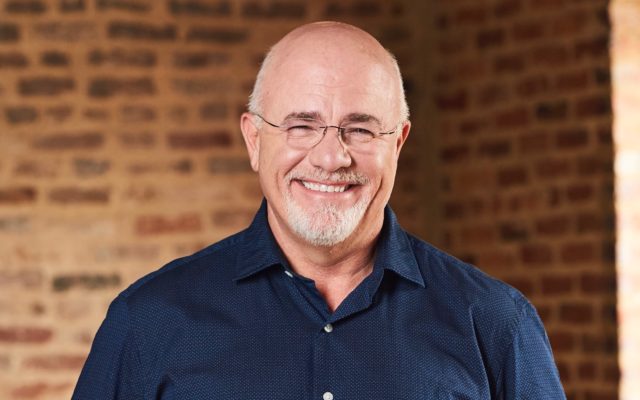

Dave Says: Why the snowball method is the best way to tackle debt

Dear Dave,

I’ve heard lots of different theories and recommendations when it comes to paying off debt. Why do you advise paying off debts from smallest to largest?

Marlee

Dear Marlee,

A lot of people wonder the same thing when I bring up the debt snowball. Some think paying off the debt with highest interest rate first is the best approach. This may seem to make sense mathematically, but I realized a long time ago debt is not a mathematics problem—it’s a behavior problem. Personal finance is 80 percent behavior, and only 20 percent head knowledge. Besides, if all those people were so great at math, they wouldn’t be up to their eyeballs in debt in the first place!

The reason the debt snowball pays off debt from smallest to largest is that modifying your behavior and providing inspiration to get out of debt is more important than the math. Your probability of becoming wealthy is more closely connected to your behavior than your financial “sophistication” or academic pedigree.

When you pay off a small debt you experience success, and that gives you hope. Then, you move on the next debt. When you pay that one off, and you’ve wiped out two debts, it really energizes you. At that point you start to get excited, and you begin to believe in yourself and in the fact you’re actually on the road to becoming debt-free!

— Dave

You Might Also Like