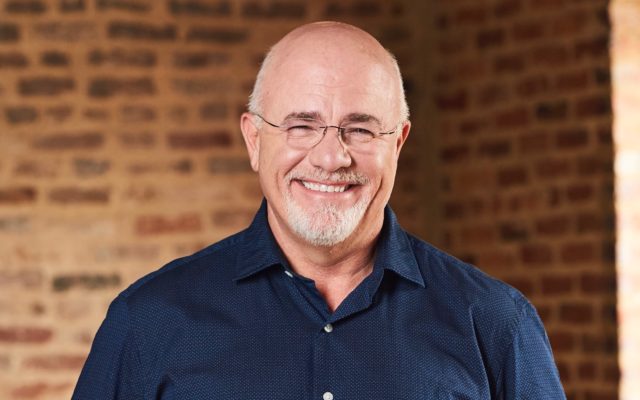

Dave Says: You always need an emergency fund

Dear Dave,

I’ll be retiring in the next couple of years. When I leave my job, we will have a yearly income of $65,000 through my pension. I don’t think we need an emergency fund with such a dependable, steady income stream like that, but my wife disagrees. She says she would feel safer if we had money set aside just for the unexpected. What do you think we should do?

Gary

Dear Gary,

A good pension can feel pretty solid, but nothing’s perfect. Nothing lasts forever. There’s always the possibility of lost income or large, unexpected expenses. What if one of you has a major medical event? Life can bite you at any time, and sometimes it will take a big financial chunk out of you. You need an emergency fund!

I recommend an emergency fund of three to six months of expenses. Put it in a good money market account with check writing privileges and a decent interest rate. That way, your money will work for you a little bit. With a solid pension like you’re talking about, you could probably lean toward the three-month side, if you wanted. Honestly though, I’d save up six months of expenses—just in case.

Trust me, a fully funded emergency fund will make you both feel better. Plus, it can turn a disaster into nothing more than an inconvenience!

—Dave

You Might Also Like